When most people talk about the electronic health record, or EHR, market, they tend to speak in terms of forward projections. They focus on the projection that the North American health care IT market will grow at a compound annual growth rate of 7.4% to $31.3 billion by 2017. They also point out that the U.S. government's HITECH legislation, started in 2009, will continue funding these businesses as medical practices are offered incentives to make "meaningful use" of their EHR services.

Shrewd investors, however, should know that forward growth projections are often far rosier than they actually are. Therefore, in our zeal to discuss the latest mobile EHR apps, speech recognition software, and biometrics technology in health care IT, we shouldn't neglect the basis of all solid, long-term investments -- the fundamentals.

In this article, I'll take a look at the fundamental growth of three leading EHR companies --Allscripts (NASDAQ: MDRX ) , Cerner (NASDAQ: CERN ) , and athenahealth(NASDAQ: ATHN ) -- and how much scaffolding supports each one.

Market share growthAllscripts, Cerner, and athenahealth are three publicly traded companies that rank in the top ten EHR companies by market share. General Electric and McKesson are also major public players in the health care IT field, but both businesses are more diversified. Privately held Epic is the market leader in larger practices, while Practice Fusion is the fastest growing company in the industry.

A look at the market share growth in the ambulatory electronic medical record, or EMR, market between July 2012 and May 2013 reveals that only Practice Fusion, athenahealth, Epic, and Cerner reported positive market growth.

Company

|

July 2012-May 2013 Market Share Growth

|

Total Overall Market Share

|

Practice Fusion

|

+53%

|

5.8%

|

athenahealth

|

+35%

|

2.3%

|

Epic

|

+6%

|

10.3%

|

Cerner

|

+3%

|

3.5%

|

Allscripts

|

-11%

|

10.6%

|

Sources: Practicefusion.com, SK&A

While it's clear that athenahealth is the fastest growing publicly traded EHR company, its market share still trails its larger peers by a wide margin. Allscripts, on the other hand, has lost significant market share over the past year, despite extensive partnerships which include collaborations with tech giant Cisco and drugstore chain CVS Caremark.

The Foolish fundamentalsNow that we've established which companies are growing and which are shrinking, we should compare their fundamental valuations.

5-year PEG

|

Trailing P/E

|

Price to Sales

|

Price to Book

|

Debt to Equity

|

Profit Margin

| |

athenahealth

|

3.79

|

17,818.33

|

7.97

|

11.76

|

73.57

|

0.09%

|

Cerner

|

1.89

|

37.67

|

5.86

|

5.39

|

6.16

|

15.99%

|

Allscripts

|

4.76

|

N/A

|

1.90

|

1.95

|

39.86

|

-3.52%

|

Advantage

|

Cerner

|

Cerner

|

Allscripts

|

Allscripts

|

Cerner

|

Cerner

|

Source: Yahoo! Finance, as of Aug. 29.

Fundamental investors should immediately notice some major problems with athenahealth -- its whopping P/E, P/S, and P/B ratios all suggest that the stock is grossly overvalued. Its 5-year PEG ratio of 3.79 also suggests sluggish growth ahead. Moreover, the company's paper-thin margins and high debt-to-equity ratio are major red flags. Allscripts has some major problems as well -- a five-year forecast for sluggish growth, a lack of profitability, and negative margins.

Cerner, on the other hand, has more stable valuations than either athenahealth or Allscripts, but the disparity between its PEG ratio and trailing P/E suggests limited upside from current levels. It also has robust double-digit margins in an industry plagued by negative profit growth.

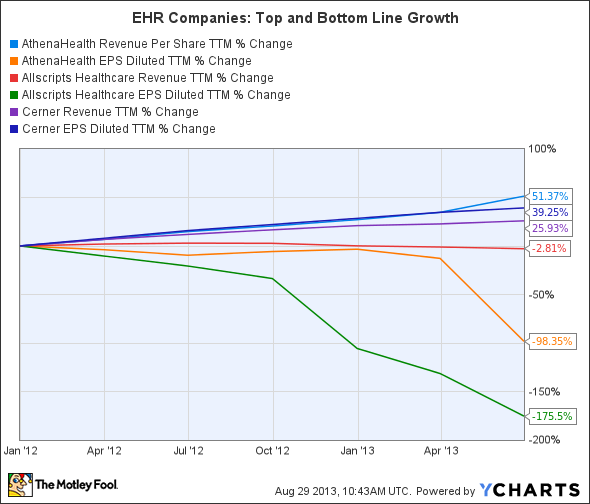

A look at the top and bottom line growth of these three companies also confirms the fact that only Cerner has been able to preserve its top and bottom line growth over the past two years.

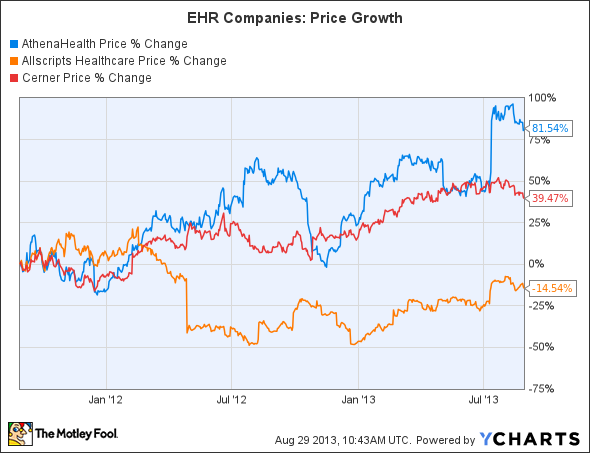

A look at the price performance of these three stocks over the same period indicates that although investors are satisfied with Cerner's solid growth, but they are more enamored with athenahealth's growth potential, despite its lack of fundamental support.

The Foolish bottom lineOf course, fundamental valuations only tell half the story for these EHR companies. To fully gauge their market value, investors should also consider their future growth prospects.

Looking forward, athenahealth investors should consider its deal with Ascension Health Alliance, which added 2,700 doctors to its EHR service, and the growth of its popular Epocrates medical reference app. Cerner investors should keep an eye on the company's partnerships with Nuance for clinical documentation improvement and voice-enabled EHR apps. Last but not least, Allscripts' partnerships with Cisco and CVS, along with its recently updated iPad EHR app, could help it regain some of its lost market share.

With the EHR market becoming more saturated every day, it can be tough to separate the winners from the losers. Although health care IT companies have yet to reach their full market potential, investors should always do their due diligence and measure each company's financial health against its future growth prospects to find the best long-term investment.

Your financial health is just as important as your personal health. The Motley Fool's special free report "3 Stocks That Will Help You Retire Rich" names specific investment opportunities that could help you build long-term wealth and help you retire well. The Fool also outlines critical wealth-building strategies that every investor should know. Click here to keep reading.

The Next Industry to Crumble...

Imagine owning Amazon.com (up over an insane 4,000% since 2001) when Internet sales rendered big-box retailers obsolete... Now an industry 99% of us use daily is set to implode... And 3 established companies are perfectly positioned to take advantage of this game-changing economic shift. Enter your email address below to find out how YOU can take advantage!

Imagine owning Amazon.com (up over an insane 4,000% since 2001) when Internet sales rendered big-box retailers obsolete... Now an industry 99% of us use daily is set to implode... And 3 established companies are perfectly positioned to take advantage of this game-changing economic shift. Enter your email address below to find out how YOU can take advantage!