six insurers received the political privilege of participating in TARP, inking onto the Treasury's sticky red column. Although two have rejected, and the dollar amounts are miniscule compared to the banks, we see nothing positive for the entire financial/insurer sector if even one of the six succumbs; especially at this point in time. The flesh wounds inflicted on TARPed banks have not healed, thus the consequences on all are ongoing and unclear. For the sake of true free-market capitalism, we urge every insurer to say no. Even if one insurer says yes, that could spell capitalistic failure for all. Here's why...

Billions of public dollars on any one private insurer's balance sheet would create unwanted and ongoing financial consequences (just ask Mr. Jamie Dimon). Unwanted accounting issues will continue to mutate with the ebb and flow of GDP and employment, as there are no guarantees in forecasting economic growth. POTC views LNC and HIG as two candidates most likely to accept TARP and adulterate their ledgers. The potential for valuation erosion and even financial extinction looms for all insurers if even one says yes to TARP, since GDP and employment could falter.

Many are concerned that commingling public-private monies will lead to free-market paralysis. Venture capitalists that may have come up with a cure for this financial and psychological paralysis will find their free-market umbilical cords clogged with unknown rules and regs if even one insurer says yes. If either LNC or HIG accept TARP, the entire sector's valuation will be called to Big Brother's boardroom.

Long-term corporate capital structure mutations will not be known for many months as GDP and employment weigh. This cloud of uncertainty will work to cripple valuations, as yet other micro elements of our financial system are deemed too big to right themselves. Thus, capital could shy away from the TARPed and unTARPed public-private insurance companies. The stigma of 'government bail-out' will induce the talented to exit TARPed doors, severely damaging the ability to attract capital. Yet the unTARPed insurers will carry huge risk if the economy stalled and at some future point in time turned to the almighty gov't.

Perhaps POTC should in fact blame some insurance sector CFOs for mismanaging balance sheet risk and now being on the verge of that sticky red TARP column. Yet greater shame on the politicians for endorsing such anti-capitalistic measures and creating what Pimco's Mohamed El-Erian calls the ‘new normal’. Our Capitalist Pig Bob calls it the "new abnormal." If the government was to step away from private sector bail-outs today, the U.S. capitalistic cow milked by the world for two hundred years might heal itself and rise up to a healthier "new normal".

Government cannot insist on taking on private capital risk, as the government is the lender of last resort and ironically deemed too big to fail in our university text books. The words backed by the "Full Faith and Credit of the U.S. Government" come to mind. Well, that statement must be rephrased if this administration continues on its path of adulterating private balance sheets. A more sensible wording today would be: backed by the "Full Faith and Credit of the U.S. Government and the Many too Big to Fail Public-Private Sectors."

Long live Wall Street, long live winners and losers, capitalists and socialists, peaks and troughs, bubbles and busts, fear and greed... all necessary micro and macro phenomena. What made the U.S.A. the model capitalistic society - and what enables healthy market cycles - is fewer political strings, not more. Even though this latest economic bust was arguably more costly and psychologically painful than any in the past, we realize every generation goes through a time when the world is coming to an end. Yet the beauty of capitalism is rooted in its risk taking private citizens, not in Bigger Brother government. Take the winners and losers out of the equation and our free-markets will die.

Capitalist Pig Bob thinks the reaction from today's D.C. regime is too extreme and will have far worse consequences than allowing markets to right themselves. Entrepreneurial seeds that would have been sown if market forces allowed bankruptcies will be hoarded. Every insurer must say No to TARP, otherwise the gov't scores yet another sector. The current regime is more concerned with social welfare than Darwinian capitalistic evolution and that is troubling. Yes, we know the elephants started this mess, yet two wrongs never made anything right.

What do Barack, Tim, Larry, Paul to pay Peter not understand?

Midterm elections Nov, 2, 2010. Never has the bell tolled so loudly against Free-Market Capitalism. We'll be logging the behaviors of the donkeys and elephants closely. Perhaps one of those two species is on the verge of Capitol extinction? You decide.

six insurers received the political privilege of participating in TARP, inking onto the Treasury's sticky red column. Although two have rejected, and the dollar amounts are miniscule compared to the banks, we see nothing positive for the entire financial/insurer sector if even one of the six succumbs; especially at this point in time. The flesh wounds inflicted on TARPed banks have not healed, thus the consequences on all are ongoing and unclear. For the sake of true free-market capitalism, we urge every insurer to say no. Even if one insurer says yes, that could spell capitalistic failure for all. Here's why...

Billions of public dollars on any one private insurer's balance sheet would create unwanted and ongoing financial consequences (just ask Mr. Jamie Dimon). Unwanted accounting issues will continue to mutate with the ebb and flow of GDP and employment, as there are no guarantees in forecasting economic growth. POTC views LNC and HIG as two candidates most likely to accept TARP and adulterate their ledgers. The potential for valuation erosion and even financial extinction looms for all insurers if even one says yes to TARP, since GDP and employment could falter.

Many are concerned that commingling public-private monies will lead to free-market paralysis. Venture capitalists that may have come up with a cure for this financial and psychological paralysis will find their free-market umbilical cords clogged with unknown rules and regs if even one insurer says yes. If either LNC or HIG accept TARP, the entire sector's valuation will be called to Big Brother's boardroom.

Long-term corporate capital structure mutations will not be known for many months as GDP and employment weigh. This cloud of uncertainty will work to cripple valuations, as yet other micro elements of our financial system are deemed too big to right themselves. Thus, capital could shy away from the TARPed and unTARPed public-private insurance companies. The stigma of 'government bail-out' will induce the talented to exit TARPed doors, severely damaging the ability to attract capital. Yet the unTARPed insurers will carry huge risk if the economy stalled and at some future point in time turned to the almighty gov't.

Perhaps POTC should in fact blame some insurance sector CFOs for mismanaging balance sheet risk and now being on the verge of that sticky red TARP column. Yet greater shame on the politicians for endorsing such anti-capitalistic measures and creating what Pimco's Mohamed El-Erian calls the ‘new normal’. Our Capitalist Pig Bob calls it the "new abnormal." If the government was to step away from private sector bail-outs today, the U.S. capitalistic cow milked by the world for two hundred years might heal itself and rise up to a healthier "new normal".

Government cannot insist on taking on private capital risk, as the government is the lender of last resort and ironically deemed too big to fail in our university text books. The words backed by the "Full Faith and Credit of the U.S. Government" come to mind. Well, that statement must be rephrased if this administration continues on its path of adulterating private balance sheets. A more sensible wording today would be: backed by the "Full Faith and Credit of the U.S. Government and the Many too Big to Fail Public-Private Sectors."

Long live Wall Street, long live winners and losers, capitalists and socialists, peaks and troughs, bubbles and busts, fear and greed... all necessary micro and macro phenomena. What made the U.S.A. the model capitalistic society - and what enables healthy market cycles - is fewer political strings, not more. Even though this latest economic bust was arguably more costly and psychologically painful than any in the past, we realize every generation goes through a time when the world is coming to an end. Yet the beauty of capitalism is rooted in its risk taking private citizens, not in Bigger Brother government. Take the winners and losers out of the equation and our free-markets will die.

Capitalist Pig Bob thinks the reaction from today's D.C. regime is too extreme and will have far worse consequences than allowing markets to right themselves. Entrepreneurial seeds that would have been sown if market forces allowed bankruptcies will be hoarded. Every insurer must say No to TARP, otherwise the gov't scores yet another sector. The current regime is more concerned with social welfare than Darwinian capitalistic evolution and that is troubling. Yes, we know the elephants started this mess, yet two wrongs never made anything right.

What do Barack, Tim, Larry, Paul to pay Peter not understand?

Midterm elections Nov, 2, 2010. Never has the bell tolled so loudly against Free-Market Capitalism. We'll be logging the behaviors of the donkeys and elephants closely. Perhaps one of those two species is on the verge of Capitol extinction? You decide.

Thursday, May 21, 2009

Insured Capitalistic Failure Looms; Please just say no...

Exactly one week ago,  six insurers received the political privilege of participating in TARP, inking onto the Treasury's sticky red column. Although two have rejected, and the dollar amounts are miniscule compared to the banks, we see nothing positive for the entire financial/insurer sector if even one of the six succumbs; especially at this point in time. The flesh wounds inflicted on TARPed banks have not healed, thus the consequences on all are ongoing and unclear. For the sake of true free-market capitalism, we urge every insurer to say no. Even if one insurer says yes, that could spell capitalistic failure for all. Here's why...

Billions of public dollars on any one private insurer's balance sheet would create unwanted and ongoing financial consequences (just ask Mr. Jamie Dimon). Unwanted accounting issues will continue to mutate with the ebb and flow of GDP and employment, as there are no guarantees in forecasting economic growth. POTC views LNC and HIG as two candidates most likely to accept TARP and adulterate their ledgers. The potential for valuation erosion and even financial extinction looms for all insurers if even one says yes to TARP, since GDP and employment could falter.

Many are concerned that commingling public-private monies will lead to free-market paralysis. Venture capitalists that may have come up with a cure for this financial and psychological paralysis will find their free-market umbilical cords clogged with unknown rules and regs if even one insurer says yes. If either LNC or HIG accept TARP, the entire sector's valuation will be called to Big Brother's boardroom.

Long-term corporate capital structure mutations will not be known for many months as GDP and employment weigh. This cloud of uncertainty will work to cripple valuations, as yet other micro elements of our financial system are deemed too big to right themselves. Thus, capital could shy away from the TARPed and unTARPed public-private insurance companies. The stigma of 'government bail-out' will induce the talented to exit TARPed doors, severely damaging the ability to attract capital. Yet the unTARPed insurers will carry huge risk if the economy stalled and at some future point in time turned to the almighty gov't.

Perhaps POTC should in fact blame some insurance sector CFOs for mismanaging balance sheet risk and now being on the verge of that sticky red TARP column. Yet greater shame on the politicians for endorsing such anti-capitalistic measures and creating what Pimco's Mohamed El-Erian calls the ‘new normal’. Our Capitalist Pig Bob calls it the "new abnormal." If the government was to step away from private sector bail-outs today, the U.S. capitalistic cow milked by the world for two hundred years might heal itself and rise up to a healthier "new normal".

Government cannot insist on taking on private capital risk, as the government is the lender of last resort and ironically deemed too big to fail in our university text books. The words backed by the "Full Faith and Credit of the U.S. Government" come to mind. Well, that statement must be rephrased if this administration continues on its path of adulterating private balance sheets. A more sensible wording today would be: backed by the "Full Faith and Credit of the U.S. Government and the Many too Big to Fail Public-Private Sectors."

Long live Wall Street, long live winners and losers, capitalists and socialists, peaks and troughs, bubbles and busts, fear and greed... all necessary micro and macro phenomena. What made the U.S.A. the model capitalistic society - and what enables healthy market cycles - is fewer political strings, not more. Even though this latest economic bust was arguably more costly and psychologically painful than any in the past, we realize every generation goes through a time when the world is coming to an end. Yet the beauty of capitalism is rooted in its risk taking private citizens, not in Bigger Brother government. Take the winners and losers out of the equation and our free-markets will die.

Capitalist Pig Bob thinks the reaction from today's D.C. regime is too extreme and will have far worse consequences than allowing markets to right themselves. Entrepreneurial seeds that would have been sown if market forces allowed bankruptcies will be hoarded. Every insurer must say No to TARP, otherwise the gov't scores yet another sector. The current regime is more concerned with social welfare than Darwinian capitalistic evolution and that is troubling. Yes, we know the elephants started this mess, yet two wrongs never made anything right.

What do Barack, Tim, Larry, Paul to pay Peter not understand?

Midterm elections Nov, 2, 2010. Never has the bell tolled so loudly against Free-Market Capitalism. We'll be logging the behaviors of the donkeys and elephants closely. Perhaps one of those two species is on the verge of Capitol extinction? You decide.

six insurers received the political privilege of participating in TARP, inking onto the Treasury's sticky red column. Although two have rejected, and the dollar amounts are miniscule compared to the banks, we see nothing positive for the entire financial/insurer sector if even one of the six succumbs; especially at this point in time. The flesh wounds inflicted on TARPed banks have not healed, thus the consequences on all are ongoing and unclear. For the sake of true free-market capitalism, we urge every insurer to say no. Even if one insurer says yes, that could spell capitalistic failure for all. Here's why...

Billions of public dollars on any one private insurer's balance sheet would create unwanted and ongoing financial consequences (just ask Mr. Jamie Dimon). Unwanted accounting issues will continue to mutate with the ebb and flow of GDP and employment, as there are no guarantees in forecasting economic growth. POTC views LNC and HIG as two candidates most likely to accept TARP and adulterate their ledgers. The potential for valuation erosion and even financial extinction looms for all insurers if even one says yes to TARP, since GDP and employment could falter.

Many are concerned that commingling public-private monies will lead to free-market paralysis. Venture capitalists that may have come up with a cure for this financial and psychological paralysis will find their free-market umbilical cords clogged with unknown rules and regs if even one insurer says yes. If either LNC or HIG accept TARP, the entire sector's valuation will be called to Big Brother's boardroom.

Long-term corporate capital structure mutations will not be known for many months as GDP and employment weigh. This cloud of uncertainty will work to cripple valuations, as yet other micro elements of our financial system are deemed too big to right themselves. Thus, capital could shy away from the TARPed and unTARPed public-private insurance companies. The stigma of 'government bail-out' will induce the talented to exit TARPed doors, severely damaging the ability to attract capital. Yet the unTARPed insurers will carry huge risk if the economy stalled and at some future point in time turned to the almighty gov't.

Perhaps POTC should in fact blame some insurance sector CFOs for mismanaging balance sheet risk and now being on the verge of that sticky red TARP column. Yet greater shame on the politicians for endorsing such anti-capitalistic measures and creating what Pimco's Mohamed El-Erian calls the ‘new normal’. Our Capitalist Pig Bob calls it the "new abnormal." If the government was to step away from private sector bail-outs today, the U.S. capitalistic cow milked by the world for two hundred years might heal itself and rise up to a healthier "new normal".

Government cannot insist on taking on private capital risk, as the government is the lender of last resort and ironically deemed too big to fail in our university text books. The words backed by the "Full Faith and Credit of the U.S. Government" come to mind. Well, that statement must be rephrased if this administration continues on its path of adulterating private balance sheets. A more sensible wording today would be: backed by the "Full Faith and Credit of the U.S. Government and the Many too Big to Fail Public-Private Sectors."

Long live Wall Street, long live winners and losers, capitalists and socialists, peaks and troughs, bubbles and busts, fear and greed... all necessary micro and macro phenomena. What made the U.S.A. the model capitalistic society - and what enables healthy market cycles - is fewer political strings, not more. Even though this latest economic bust was arguably more costly and psychologically painful than any in the past, we realize every generation goes through a time when the world is coming to an end. Yet the beauty of capitalism is rooted in its risk taking private citizens, not in Bigger Brother government. Take the winners and losers out of the equation and our free-markets will die.

Capitalist Pig Bob thinks the reaction from today's D.C. regime is too extreme and will have far worse consequences than allowing markets to right themselves. Entrepreneurial seeds that would have been sown if market forces allowed bankruptcies will be hoarded. Every insurer must say No to TARP, otherwise the gov't scores yet another sector. The current regime is more concerned with social welfare than Darwinian capitalistic evolution and that is troubling. Yes, we know the elephants started this mess, yet two wrongs never made anything right.

What do Barack, Tim, Larry, Paul to pay Peter not understand?

Midterm elections Nov, 2, 2010. Never has the bell tolled so loudly against Free-Market Capitalism. We'll be logging the behaviors of the donkeys and elephants closely. Perhaps one of those two species is on the verge of Capitol extinction? You decide.

six insurers received the political privilege of participating in TARP, inking onto the Treasury's sticky red column. Although two have rejected, and the dollar amounts are miniscule compared to the banks, we see nothing positive for the entire financial/insurer sector if even one of the six succumbs; especially at this point in time. The flesh wounds inflicted on TARPed banks have not healed, thus the consequences on all are ongoing and unclear. For the sake of true free-market capitalism, we urge every insurer to say no. Even if one insurer says yes, that could spell capitalistic failure for all. Here's why...

Billions of public dollars on any one private insurer's balance sheet would create unwanted and ongoing financial consequences (just ask Mr. Jamie Dimon). Unwanted accounting issues will continue to mutate with the ebb and flow of GDP and employment, as there are no guarantees in forecasting economic growth. POTC views LNC and HIG as two candidates most likely to accept TARP and adulterate their ledgers. The potential for valuation erosion and even financial extinction looms for all insurers if even one says yes to TARP, since GDP and employment could falter.

Many are concerned that commingling public-private monies will lead to free-market paralysis. Venture capitalists that may have come up with a cure for this financial and psychological paralysis will find their free-market umbilical cords clogged with unknown rules and regs if even one insurer says yes. If either LNC or HIG accept TARP, the entire sector's valuation will be called to Big Brother's boardroom.

Long-term corporate capital structure mutations will not be known for many months as GDP and employment weigh. This cloud of uncertainty will work to cripple valuations, as yet other micro elements of our financial system are deemed too big to right themselves. Thus, capital could shy away from the TARPed and unTARPed public-private insurance companies. The stigma of 'government bail-out' will induce the talented to exit TARPed doors, severely damaging the ability to attract capital. Yet the unTARPed insurers will carry huge risk if the economy stalled and at some future point in time turned to the almighty gov't.

Perhaps POTC should in fact blame some insurance sector CFOs for mismanaging balance sheet risk and now being on the verge of that sticky red TARP column. Yet greater shame on the politicians for endorsing such anti-capitalistic measures and creating what Pimco's Mohamed El-Erian calls the ‘new normal’. Our Capitalist Pig Bob calls it the "new abnormal." If the government was to step away from private sector bail-outs today, the U.S. capitalistic cow milked by the world for two hundred years might heal itself and rise up to a healthier "new normal".

Government cannot insist on taking on private capital risk, as the government is the lender of last resort and ironically deemed too big to fail in our university text books. The words backed by the "Full Faith and Credit of the U.S. Government" come to mind. Well, that statement must be rephrased if this administration continues on its path of adulterating private balance sheets. A more sensible wording today would be: backed by the "Full Faith and Credit of the U.S. Government and the Many too Big to Fail Public-Private Sectors."

Long live Wall Street, long live winners and losers, capitalists and socialists, peaks and troughs, bubbles and busts, fear and greed... all necessary micro and macro phenomena. What made the U.S.A. the model capitalistic society - and what enables healthy market cycles - is fewer political strings, not more. Even though this latest economic bust was arguably more costly and psychologically painful than any in the past, we realize every generation goes through a time when the world is coming to an end. Yet the beauty of capitalism is rooted in its risk taking private citizens, not in Bigger Brother government. Take the winners and losers out of the equation and our free-markets will die.

Capitalist Pig Bob thinks the reaction from today's D.C. regime is too extreme and will have far worse consequences than allowing markets to right themselves. Entrepreneurial seeds that would have been sown if market forces allowed bankruptcies will be hoarded. Every insurer must say No to TARP, otherwise the gov't scores yet another sector. The current regime is more concerned with social welfare than Darwinian capitalistic evolution and that is troubling. Yes, we know the elephants started this mess, yet two wrongs never made anything right.

What do Barack, Tim, Larry, Paul to pay Peter not understand?

Midterm elections Nov, 2, 2010. Never has the bell tolled so loudly against Free-Market Capitalism. We'll be logging the behaviors of the donkeys and elephants closely. Perhaps one of those two species is on the verge of Capitol extinction? You decide.

six insurers received the political privilege of participating in TARP, inking onto the Treasury's sticky red column. Although two have rejected, and the dollar amounts are miniscule compared to the banks, we see nothing positive for the entire financial/insurer sector if even one of the six succumbs; especially at this point in time. The flesh wounds inflicted on TARPed banks have not healed, thus the consequences on all are ongoing and unclear. For the sake of true free-market capitalism, we urge every insurer to say no. Even if one insurer says yes, that could spell capitalistic failure for all. Here's why...

Billions of public dollars on any one private insurer's balance sheet would create unwanted and ongoing financial consequences (just ask Mr. Jamie Dimon). Unwanted accounting issues will continue to mutate with the ebb and flow of GDP and employment, as there are no guarantees in forecasting economic growth. POTC views LNC and HIG as two candidates most likely to accept TARP and adulterate their ledgers. The potential for valuation erosion and even financial extinction looms for all insurers if even one says yes to TARP, since GDP and employment could falter.

Many are concerned that commingling public-private monies will lead to free-market paralysis. Venture capitalists that may have come up with a cure for this financial and psychological paralysis will find their free-market umbilical cords clogged with unknown rules and regs if even one insurer says yes. If either LNC or HIG accept TARP, the entire sector's valuation will be called to Big Brother's boardroom.

Long-term corporate capital structure mutations will not be known for many months as GDP and employment weigh. This cloud of uncertainty will work to cripple valuations, as yet other micro elements of our financial system are deemed too big to right themselves. Thus, capital could shy away from the TARPed and unTARPed public-private insurance companies. The stigma of 'government bail-out' will induce the talented to exit TARPed doors, severely damaging the ability to attract capital. Yet the unTARPed insurers will carry huge risk if the economy stalled and at some future point in time turned to the almighty gov't.

Perhaps POTC should in fact blame some insurance sector CFOs for mismanaging balance sheet risk and now being on the verge of that sticky red TARP column. Yet greater shame on the politicians for endorsing such anti-capitalistic measures and creating what Pimco's Mohamed El-Erian calls the ‘new normal’. Our Capitalist Pig Bob calls it the "new abnormal." If the government was to step away from private sector bail-outs today, the U.S. capitalistic cow milked by the world for two hundred years might heal itself and rise up to a healthier "new normal".

Government cannot insist on taking on private capital risk, as the government is the lender of last resort and ironically deemed too big to fail in our university text books. The words backed by the "Full Faith and Credit of the U.S. Government" come to mind. Well, that statement must be rephrased if this administration continues on its path of adulterating private balance sheets. A more sensible wording today would be: backed by the "Full Faith and Credit of the U.S. Government and the Many too Big to Fail Public-Private Sectors."

Long live Wall Street, long live winners and losers, capitalists and socialists, peaks and troughs, bubbles and busts, fear and greed... all necessary micro and macro phenomena. What made the U.S.A. the model capitalistic society - and what enables healthy market cycles - is fewer political strings, not more. Even though this latest economic bust was arguably more costly and psychologically painful than any in the past, we realize every generation goes through a time when the world is coming to an end. Yet the beauty of capitalism is rooted in its risk taking private citizens, not in Bigger Brother government. Take the winners and losers out of the equation and our free-markets will die.

Capitalist Pig Bob thinks the reaction from today's D.C. regime is too extreme and will have far worse consequences than allowing markets to right themselves. Entrepreneurial seeds that would have been sown if market forces allowed bankruptcies will be hoarded. Every insurer must say No to TARP, otherwise the gov't scores yet another sector. The current regime is more concerned with social welfare than Darwinian capitalistic evolution and that is troubling. Yes, we know the elephants started this mess, yet two wrongs never made anything right.

What do Barack, Tim, Larry, Paul to pay Peter not understand?

Midterm elections Nov, 2, 2010. Never has the bell tolled so loudly against Free-Market Capitalism. We'll be logging the behaviors of the donkeys and elephants closely. Perhaps one of those two species is on the verge of Capitol extinction? You decide.

Tuesday, May 19, 2009

Obama's Anti-Capitalistic Brilliance Hoodwinks Elephants, Uses Swine Flu to Advance an Unfriendly Businesswoman to Head FDA; as CPB Predicted...

WASHINGTON (Dow Jones)--The U.S. Senate voted unanimously Monday to approve Margaret Hamburg as head of the Food and Drug Administration, giving her the reins to an agency under intense public and congressional pressure to better police the nation's health products.

Hamburg, 53, will be heading an agency that has been severely underfunded for more than a decade and is struggling to ensure the safety of imported products and medicines, such as heparin, from China.

It has also had to deal with multiple food outbreaks involving peanut butter, tomatoes and spinach. She will also have to gain the trust of FDA employees, many who have complained to Congress and President Barack Obama about being overruled by FDA managers on scientific decisions.

Hamburg told the Senate last month that she understands the agency's troubles and "would very much like to create a culture that would enable all voices to be heard."

Her post has been one of the most contested behind the scenes and the food, drug, device and health industries have all been lobbying for candidates considered more business friendly and less consumer oriented. When she was nominated in March, the White House named another candidate associated with safety and consumer issues, Joshua Sharfstein, as the FDA's principal deputy commissioner. He is currently acting head of the FDA.

Hamburg's specialty is bioterrorism and pandemics. Her expertise in dealing with these issues, in light of the swine flu outbreak, contributed to bipartisan willingness to approve her with little opposition.

Hamburg has said her top priority will be to improve food safety.

Obama has also said he wants to improve the safety of the nation's food supply, and his budget proposal released this month included $783 million for food oversight efforts. That compares with $649 million in the prior year.

Hamburg comes to the job with experience in public health and bioterrorism. In New York City, she headed the city's health department during the 1990s and quickly won praise for her aggressive actions on AIDS and an epidemic of tuberculosis. She has been praised for quickly stockpiling supplies of a smallpox vaccine when the Clinton administration became concerned in the late 1990s about the possibility of a chemical-warfare attack by Iraq.

Hamburg refused to take a morality oath demanded by the Board of Education in 1992 while the city was debating sex education in schools, saying science-driven methods, not "wishful thinking," should be the basis for educating youngsters on how to avoid AIDS.

Her expertise in dealing with pandemics will likely come in hand quickly as the U.S. faces an outbreak of the A/H1N1 influenza, also known as swine flu. Although the outbreak has been milder than expected, officials are bracing for a possible resurgence after the summer. The Centers for Disease Control and Prevention on Monday reported more than 5,100 confirmed and probable cases in 47 states and the District of Columbia, and Sunday a New York City man became the sixth person to die from the disease in the U.S. More than 36,000 people die from the seasonal flu annually in the U.S.

The FDA has been working closely with the pharmaceutical industry to come up with a vaccine and ensure there are enough antivirals ready in case the outbreak widens.

Hamburg may also have deal with a new area of regulation for the FDA: tobacco. The House has approved a bill that would give the FDA power to regulate tobacco, but the legislation faces opposition in the Senate from some lawmakers in tobacco-producing states. Critics argue the legislation will further strain the agency, but the FDA's oversight will be paid for by user fees from the industry.

Indeed, Republican Mike Enzi of Wyoming, ranking member of the Senate Health, Education, Labor and Pensions Committee, said he supports Hamburg and wants his colleagues to also but doesn't endorse the tobacco regulation. "FDA resources are already stretched too thin - I have serious concerns about adding tobacco to the list of products the agency must regulate," he said in a statement Wednesday.

Hamburg told a Senate panel earlier this month that she supports letting the FDA regulate tobacco, saying "If done successfully, we can reduce smoking and we can make cigarettes less harmful."

-By Jared A. Favole and Corey Boles, Dow Jones Newswires; 202.862.9207; jared.favole@dowjones.com

(Alicia Mundy contributed to this report.)

Click here to go to Dow Jones NewsPlus, a web front page of today's most important business and market news, analysis and commentary: http://www.djnewsplus.com/access/al?rnd=sHihGrv5aLF4CzQ%2F8Oj99A%3D%3D. You can use this link on the day this article is published and the following day.

(END) Dow Jones Newswires

May 18, 2009 19:04 ET (23:04 GMT)

Copyright (c) 2009 Dow Jones & Company, Inc.- - 07 04 PM EDT 05-18-09

WASHINGTON (Dow Jones)--The U.S. Senate voted unanimously Monday to approve Margaret Hamburg as head of the Food and Drug Administration, giving her the reins to an agency under intense public and congressional pressure to better police the nation's health products.

Hamburg, 53, will be heading an agency that has been severely underfunded for more than a decade and is struggling to ensure the safety of imported products and medicines, such as heparin, from China.

It has also had to deal with multiple food outbreaks involving peanut butter, tomatoes and spinach. She will also have to gain the trust of FDA employees, many who have complained to Congress and President Barack Obama about being overruled by FDA managers on scientific decisions.

Hamburg told the Senate last month that she understands the agency's troubles and "would very much like to create a culture that would enable all voices to be heard."

Her post has been one of the most contested behind the scenes and the food, drug, device and health industries have all been lobbying for candidates considered more business friendly and less consumer oriented. When she was nominated in March, the White House named another candidate associated with safety and consumer issues, Joshua Sharfstein, as the FDA's principal deputy commissioner. He is currently acting head of the FDA.

Hamburg's specialty is bioterrorism and pandemics. Her expertise in dealing with these issues, in light of the swine flu outbreak, contributed to bipartisan willingness to approve her with little opposition.

Hamburg has said her top priority will be to improve food safety.

Obama has also said he wants to improve the safety of the nation's food supply, and his budget proposal released this month included $783 million for food oversight efforts. That compares with $649 million in the prior year.

Hamburg comes to the job with experience in public health and bioterrorism. In New York City, she headed the city's health department during the 1990s and quickly won praise for her aggressive actions on AIDS and an epidemic of tuberculosis. She has been praised for quickly stockpiling supplies of a smallpox vaccine when the Clinton administration became concerned in the late 1990s about the possibility of a chemical-warfare attack by Iraq.

Hamburg refused to take a morality oath demanded by the Board of Education in 1992 while the city was debating sex education in schools, saying science-driven methods, not "wishful thinking," should be the basis for educating youngsters on how to avoid AIDS.

Her expertise in dealing with pandemics will likely come in hand quickly as the U.S. faces an outbreak of the A/H1N1 influenza, also known as swine flu. Although the outbreak has been milder than expected, officials are bracing for a possible resurgence after the summer. The Centers for Disease Control and Prevention on Monday reported more than 5,100 confirmed and probable cases in 47 states and the District of Columbia, and Sunday a New York City man became the sixth person to die from the disease in the U.S. More than 36,000 people die from the seasonal flu annually in the U.S.

The FDA has been working closely with the pharmaceutical industry to come up with a vaccine and ensure there are enough antivirals ready in case the outbreak widens.

Hamburg may also have deal with a new area of regulation for the FDA: tobacco. The House has approved a bill that would give the FDA power to regulate tobacco, but the legislation faces opposition in the Senate from some lawmakers in tobacco-producing states. Critics argue the legislation will further strain the agency, but the FDA's oversight will be paid for by user fees from the industry.

Indeed, Republican Mike Enzi of Wyoming, ranking member of the Senate Health, Education, Labor and Pensions Committee, said he supports Hamburg and wants his colleagues to also but doesn't endorse the tobacco regulation. "FDA resources are already stretched too thin - I have serious concerns about adding tobacco to the list of products the agency must regulate," he said in a statement Wednesday.

Hamburg told a Senate panel earlier this month that she supports letting the FDA regulate tobacco, saying "If done successfully, we can reduce smoking and we can make cigarettes less harmful."

-By Jared A. Favole and Corey Boles, Dow Jones Newswires; 202.862.9207; jared.favole@dowjones.com

(Alicia Mundy contributed to this report.)

Click here to go to Dow Jones NewsPlus, a web front page of today's most important business and market news, analysis and commentary: http://www.djnewsplus.com/access/al?rnd=sHihGrv5aLF4CzQ%2F8Oj99A%3D%3D. You can use this link on the day this article is published and the following day.

(END) Dow Jones Newswires

May 18, 2009 19:04 ET (23:04 GMT)

Copyright (c) 2009 Dow Jones & Company, Inc.- - 07 04 PM EDT 05-18-09

Sunday, May 17, 2009

180 Degree Turn from Bank Nationalization for Real? POTC thinks the TARPed vs unTARPed will Create New Conundrum, Caution to a 360 Turn W/In 1 Yr...

Charlie Gasparino is reporting Goldman Sachs and JP Morgan may be the first firms freed fromTARP: http://www.thedailybeast.com/blogs-and-stories/2009-05-15/payback-time-for-goldman/ POTC believes this will be one of the key drivers for market sentiment in the week ahead. Large institutional managers like Pimco's El-Erian may begin increasing equity exposure. El-Erian's current equity allocation is around 30%. (60% is maximum equity exposure at Pimco). IF Goldman and JP are allowed to payback TARP with zero strings, it could shatter belief that Obama's economic team intends holding well capitalized banks captive from capitalism.

The political component of the Psychological Financial Fusiuon ratio (PFF ratio) will have to be addressed/tweaked as this rumor becomes fact. Cheers to it being true, and hats off to Charlie Gasparino for working weekends. Gasparino is a fiscal conservative who appears often on The Kudlow Report, 7PM ET, CNBC. We will not miss Monday's show. The debate on the potential twists of TARP paybacks will definitely go beyond the background music. The business consequences for banks with and without TARP will make for fascinating speculation. Especially with the future ebbs and flows of GDP and employment...

A question and some answers to consider:

IF the U.S. Gov't allows TARP payback for some better capitalized banks like GS and JPM, would it have a meaningful impact, +/-10%, on the broad market/S&P within 1 year of the official Treasury announcement:

A) Yes, S&P should climb 10%+ because investor sentiment would improve, the Obama economic team would score free-market credibility. The massive gov't spend/stimulus within 1 year will help GDP and employment, and all banks will be freed from TARP.

B) Yes, S&P should fall 10%+ because the TARPed banks would weigh more negatively on sentiment in the short and long-run than the unTARPed banks' short-term technical blips. IF GDP and employment failed to respond to the massive gov't spend/stimulus within 1 year, the unTARPed banks' valuations would get crucified if they went back to the Treasury's door for TARP II. The TARPed CitiGroups would remain cheap and much less volatile. The "Nationalization" Kudlow and Gasparino addressed would then become reality.

C) No, I expect a more muted S&P reaction than 10% after the official TARP payback is announced within 1 year...

IF you are a subscriber to this blog, thank you!

IF you have not yet subscribed, and care to support our fiscal conservative efforts, please send us an email and we'll add you to the smart list of forward-thinkers: Psychologyofthecall@gmail.com

Charlie Gasparino is reporting Goldman Sachs and JP Morgan may be the first firms freed fromTARP: http://www.thedailybeast.com/blogs-and-stories/2009-05-15/payback-time-for-goldman/ POTC believes this will be one of the key drivers for market sentiment in the week ahead. Large institutional managers like Pimco's El-Erian may begin increasing equity exposure. El-Erian's current equity allocation is around 30%. (60% is maximum equity exposure at Pimco). IF Goldman and JP are allowed to payback TARP with zero strings, it could shatter belief that Obama's economic team intends holding well capitalized banks captive from capitalism.

The political component of the Psychological Financial Fusiuon ratio (PFF ratio) will have to be addressed/tweaked as this rumor becomes fact. Cheers to it being true, and hats off to Charlie Gasparino for working weekends. Gasparino is a fiscal conservative who appears often on The Kudlow Report, 7PM ET, CNBC. We will not miss Monday's show. The debate on the potential twists of TARP paybacks will definitely go beyond the background music. The business consequences for banks with and without TARP will make for fascinating speculation. Especially with the future ebbs and flows of GDP and employment...

A question and some answers to consider:

IF the U.S. Gov't allows TARP payback for some better capitalized banks like GS and JPM, would it have a meaningful impact, +/-10%, on the broad market/S&P within 1 year of the official Treasury announcement:

A) Yes, S&P should climb 10%+ because investor sentiment would improve, the Obama economic team would score free-market credibility. The massive gov't spend/stimulus within 1 year will help GDP and employment, and all banks will be freed from TARP.

B) Yes, S&P should fall 10%+ because the TARPed banks would weigh more negatively on sentiment in the short and long-run than the unTARPed banks' short-term technical blips. IF GDP and employment failed to respond to the massive gov't spend/stimulus within 1 year, the unTARPed banks' valuations would get crucified if they went back to the Treasury's door for TARP II. The TARPed CitiGroups would remain cheap and much less volatile. The "Nationalization" Kudlow and Gasparino addressed would then become reality.

C) No, I expect a more muted S&P reaction than 10% after the official TARP payback is announced within 1 year...

IF you are a subscriber to this blog, thank you!

IF you have not yet subscribed, and care to support our fiscal conservative efforts, please send us an email and we'll add you to the smart list of forward-thinkers: Psychologyofthecall@gmail.com

Thursday, May 14, 2009

Control Donk Kanjorski is Convinced the Private Insurance Sector Cannot Evolve on its Own; it Must be Scolded with Genius Gov't Regs...

WASHINGTON (Dow Jones)--U.S. House lawmakers showed little consensus on whether the federal government should play some role in regulating the insurance industry on Thursday, as supporters and detractors sought to use the financial crisis to bolster their claims.

"We can no longer continue to ask the question about whether the federal government should oversee insurance. The answer here is clearly yes," said Rep. Paul Kanjorski, D-Pa., a long-time supporter of increasing the government's role in insurance regulation.

But Rep. Jackie Speier of California, a fellow Democrat, said that replacing the current state-based regulatory system is "seriously misplaced and misguided." The insurance industry and its lobbyists are looking to dull down consumer protections, she said.

The debate over whether the federal government should have a role in overseeing insurance has been simmering for years in Congress, but legislation creating an optional federal insurance charter has never gained the momentum proponents have sought. Supporters hope the current financial crisis, including the prominent role of American International Group Inc. (AIG), will change the dynamic.

"The events of last year really changed the debate on regulatory reform," said Rep. Ed Royce, R-Calif.

Kanjorski, who chairs a key House Financial Services subcommittee, said the experience with AIG, problems in the bond insurance market, and the decision by some insurers to seek bailout funds from the Treasury Department highlight the need for a federal oversight role. State regulators have by and large "performed well," Kanjorski said, but the complexity and scope of some insurers may require federal regulation.

But some lawmakers worry that the push for optional federal regulation is an attempt by insurers to copy the playbook of their banking industry brethren: use competition among regulators to weaken regulation.

Rep. Scott Garrett, R-N.J., said the insurance industry may also run the risk of opening a regulatory Pandora's Box by pushing for federal oversight.

"It's not too far-fetched to see a tri-layered or even quadruple-layered regulatory structure for insurance when all the dust settles," Garrett said.

-By Michael R. Crittenden, Dow Jones Newswires; 202-862-9273; michael.crittenden@dowjones.com

Click here to go to Dow Jones NewsPlus, a web front page of today's most important business and market news, analysis and commentary: http://www.djnewsplus.com/access/al?rnd=lqurHzy54Ksoo8yrPNKWxA%3D%3D. You can use this link on the day this article is published and the following day.

(END) Dow Jones Newswires

May 14, 2009 11:36 ET (15:36 GMT)

Copyright (c) 2009 Dow Jones & Company, Inc.- - 11 36 AM EDT 05-14-09

Wednesday, May 13, 2009

POTC Prefers Zigging when Sentiment is Zagging; You almost have to be Anti-Free Market to be Holding Long During this Political Freak Show...

NEW YORK (Dow Jones)--Bullish sentiment rose among financial advisers surveyed in the weekly Investors' Intelligence poll from last Friday.

The percentage of financial advisers who are bullish on the market rose to 41.0% from 40.4%, while bearish sentiment rose to 33.7% from 31.5%.

The percentage of financial advisers expecting a market correction fell to 25.3% from 28.1%.

In the week ended Tuesday, 86.61% of stocks listed on the New York Stock Exchange were above their 10-week moving averages.

Also, 57.31% of NYSE stocks were above their 30-week averages.

Source: InvestorsIntelligence.com

Click here to go to Dow Jones NewsPlus, a web front page of today's most important business and market news, analysis and commentary: http://www.djnewsplus.com/access/al?rnd=pHu%2BPCGrMmEFJs1uAB4ICQ%3D%3D. You can use this link on the day this article is published and the following day.

(END) Dow Jones Newswires

May 13, 2009 11:21 ET (15:21 GMT)

Copyright (c) 2009 Dow Jones & Company, Inc.- - 11 21 AM EDT 05-13-09

NEW YORK (Dow Jones)--Bullish sentiment rose among financial advisers surveyed in the weekly Investors' Intelligence poll from last Friday.

The percentage of financial advisers who are bullish on the market rose to 41.0% from 40.4%, while bearish sentiment rose to 33.7% from 31.5%.

The percentage of financial advisers expecting a market correction fell to 25.3% from 28.1%.

In the week ended Tuesday, 86.61% of stocks listed on the New York Stock Exchange were above their 10-week moving averages.

Also, 57.31% of NYSE stocks were above their 30-week averages.

Source: InvestorsIntelligence.com

Click here to go to Dow Jones NewsPlus, a web front page of today's most important business and market news, analysis and commentary: http://www.djnewsplus.com/access/al?rnd=pHu%2BPCGrMmEFJs1uAB4ICQ%3D%3D. You can use this link on the day this article is published and the following day.

(END) Dow Jones Newswires

May 13, 2009 11:21 ET (15:21 GMT)

Copyright (c) 2009 Dow Jones & Company, Inc.- - 11 21 AM EDT 05-13-09

Tuesday, May 12, 2009

Pimco's El-Erian, a Giant Investment Finance Mind, Reveals a Fogged Economic Forecast; Fraught with Market Risks Anchored in Bigger Gov't...

The leaders of giant bond-fund manager Pacific Investment Management Co. foresee a world of muted growth over the next three to five years amid a continuing shift toward emerging economies like China, co-chief executive Mohamed El-Erian said in his May secular outlook.

The world has changed in a manner that is unlikely to be reversed over the next few years as markets are recovering from a shock that goes beyond a cyclical flesh wound, El-Erian added, saying he doesn't project a return to the high growth and low inflation that characterized the period from 2002 to 2007.

There are insufficient demand buffers and structural reforms, he said, to provide for a spontaneous and sustainable recovery in the global economy, which has seen a shift to where the public sector provides private goods from a world where the private sector provided public goods.

As for the banking sector, El-Erian said it will be derisked, delevered and subject to greater burden sharing, leaving it a shadow of its former self. Furthermore, consolidation and shrinkage will spread beyond banks to other financial institutions and the investment management industry.

El-Erian also warned it's hard to project any imminent pickup in inflation amid the collapse in global demand and large output gap. Private components of global demand won't recover quickly and fully, he added. The historical pace of growth in potential output will face many challenges amid excessive regulation, higher taxation and government intervention.

Finally, he identified several risk factors for long-term investments Pimco will be monitoring in the next few months, including politics, the functioning of the markets, the management of public debt in industrial countries and any further erosion in the autonomy of key economic institutions.

-By Lauren Pollock, Dow Jones Newswires; 201-938-5964; lauren.pollock@dowjones.com

Click here to go to Dow Jones NewsPlus, a web front page of today's most important business and market news, analysis and commentary: http://www.djnewsplus.com/access/al?rnd=Uf07HjH2E3kguvqrobPF6w%3D%3D. You can use this link on the day this article is published and the following day.

(END) Dow Jones Newswires

May 12, 2009 14:53 ET (18:53 GMT)

Copyright (c) 2009 Dow Jones & Company, Inc.- - 02 53 PM EDT 05-12-09

Donkeys Insist on Raising Taxes Even in the Midst of the Most Severe Economic Crisis; Asinine Leadership...

WASHINGTON (Dow Jones)--House Democratic leaders aim to introduce legislation next month to overhaul U.S. health care, but still haven't figured out how to pay for it, a senior advisor to House Speaker Nancy Pelosi said Thursday.

"I think all options are on the table," Wendell Primus, a senior policy advisor to Pelosi, D-Calif., told the National Economists Club in an address on health care reform.

One option would be to tax employer-provided health care benefits as income. Although some dismiss the idea, Primus said lawmakers may need the tax revenue to provide health insurance to those who can't afford to buy it.

Higher taxes on wealthy Americans and fines on firms that don't offer health insurance to employees are other likely funding sources, Primus added. He didn't rule out options such as a "sugar tax" on fattening foods, but said that could unleash a "public outcry."

President Barack Obama has pushed for a health care overhaul, and Primus said House leaders plan to unveil a single bill in mid-to-late June, move it through the relevant committees in July, and bring it to a vote by the full House by August.

House Education and Labor Committee Chairman George Miller, D-Calif., House Energy and Commerce Committee Chairman Henry Waxman, D-Calif., and House Ways and Means Committee Chairman Charles Rangel, D-N.Y., are working to develop the bill, but figuring out how to pay for it could be a hitch.

The Congressional Budget Office has provided preliminary estimates of potential savings and revenue should the bill become law, and the numbers "are not as high as I would have thought," Primus said. He estimated that filling the gap will require raising "hundreds of billions" of dollars over a ten-year period, on top of the $634 billion allocated by Obama's budget over the same ten-year period.

House Democratic leaders want to see just how big the gap is before determining how to fill it, Primus added. He said congressional budgeters will need more details on the bill to provide a final price tag, and acknowledged the give-and-take could delay the ambitious timetable.

Broad outlines are in place, however. Lawmakers look to expand the current health care system by requiring individuals to have health insurance for themselves and dependent children, with federal subsidies to help low-income earners afford to buy such coverage.

Employers likely will have a choice to "pay or play," so those who currently offer health insurance to employees will be encouraged to continue doing so, and those who don't will pay fines that help cover the nation's health-care tab.

Existing private health care insurance would remain, but Primus expects House lawmakers will create a new "public plan option" for those currently uninsured, and substantially expand Medicaid, the federal health program targeted to the poor.

Hospitals that get federal payments to offset costs of treating the uninsured could see those payments cut or eliminated under the plan, and Primus said, "believe me, they will scream" at the prospect.

Drug companies likely will take a hit as well. Among other things, Primus said lawmakers want to end preferential treatment for biologics, saying they offer drug makers "a life-time monopoly" unlike patents on chemical compounds that eventually expire, allowing competition from cheaper generic producers.

Tobacco companies won't be targeted, even though critics say the industry's products are a leading cause of costly heart and lung diseases.

"We've done as much as we're going to in the tobacco arena," said Primus, noting Congress recently slapped a hefty tax on cigarettes to fund expanded health care for uninsured children, and the House adopted a bill that would allow the Food and Drug Administration to regulate the tobacco industry.

While the U.S. spends far more than any other developed country on health care, reform advocates say it doesn't always get high-quality treatment, particularly for the 50 million who lack health insurance. Rapid increases in spending on Medicare programs for the elderly and on Medicaid are another worry for lawmakers facing a mounting federal budget deficit.

Primus conceded the debate on health care is highly partisan and that industry lobbying groups are flexing their muscles to protect their interests.

"I'm not going to tell you they don't have influence," he said of lobbyists. But, he added, "we're going to write a very good health care bill despite them."

-By Judith Burns, Dow Jones Newswires; 202-862-6692; Judith.Burns@dowjones.com

Click here to go to Dow Jones NewsPlus, a web front page of today's most important business and market news, analysis and commentary: http://www.djnewsplus.com/access/al?rnd=wU45iLxieWBydwdmTFSsAw%3D%3D. You can use this link on the day this article is published and the following day.

(END) Dow Jones Newswires

May 07, 2009 16:21 ET (20:21 GMT)

Copyright (c) 2009 Dow Jones & Company, Inc.- - 04 21 PM EDT 05-07-09

Monday, May 11, 2009

Obama: Raising Taxes, Redistributing Wealth, and Pulling the Rug from Under Private Sectors; CPB is Disgusted with this Donkey Regime so Far...

WASHINGTON (Dow Jones)--The White House on Monday proposed an additional $59 billion in changes to the tax code that would help pay for the cost of efforts to cover the more than 40 million Americans without health insurance, including a substantial tightening of estate and gift tax rules.

Other new revenue raisers would affect life insurance products, limit certain accounting methods, and bar the paper industry from reaping a tax credit for a recycled fuel known as "black liquor."

Budget documents released Monday reiterate U.S. President Barack Obama's plans to create a $630 billion "health reform reserve fund" to help pay for the health-care efforts, which are expected to cost at least $1.2 trillion over 10 years. Tax provisions in the plan should cover $325.6 billion of the reserve fund, with the rest coming from savings to the federal government's health-related costs.

The centerpiece of the tax proposals - a limit on charitable deductions for taxpayers in the top two income brackets - was rolled out earlier this year and remains in the proposal.

But the White House dropped its estimate of how much that proposal would raise, from $317.8 billion to $266.7 billion over 10 years. The charitable deductions proposal has drawn opposition from congressional Democrats.

On Monday, the White House added several other tax-generating proposals to supplement that plan, including proposed changes to estate and gift tax laws. The plan would require "consistent valuation [of property] for transfer and income tax purposes." According to the White House, the estate and gift tax provisions would raise $24.2 billion over 10 years.

Another proposal would end the paper industry's practice of combining liquid byproducts from the production of paper - or so-called "black liquor" - with diesel fuel to receive alternative fuel tax credits.

The alternative fuel mixture credit is slated to expire at the end of this year, and lawmakers, including Sen. Max Baucus, D-Mont., had vowed to shut down paper companies' use of the credit either by not renewing the credit with respect to "black liquor" or passing legislation earlier to block it.

The White House is proposing to deny paper companies access to the credit immediately when legislation to block the tax benefit is signed by the president.

The budget also seeks to take away some tax breaks for the life insurance industry, raising $12.7 billion over 10 years, according to the White House estimate.

Life insurers follow special rules when determining how much to deduct for dividends received on investments in common stock. The White House is proposing to further restrict those deductions.

In addition, the Obama administration wants to modify rules governing deductibility of expenses related to the sale of life insurance contracts, including sales commissions.

Another proposal in the bill seeks to improve the enforcement of current tax laws, including a requirement that some business file their tax returns electronically. The White House would seek greater penalties for companies required to file electronically that did not do so.

The tax enforcement changes would raise an estimated $10.4 billion over 10 years.

The administration in February outlined other provisions that would raise revenues for the health reserve fund, but through changes to Medicare payments.

The most significant Medicare provision would put in place vast reductions in payments to private insurers through the Medicare Advantage program, creating a competitive bidding system to make Medicare Advantage payments more comparable to payments through the government's traditional Medicare fee-for-service program. That provision is slated to save $175 billion over 10 years.

-By Patrick Yoest and Martin Vaughan, Dow Jones Newswires; 202-862-3554; patrick.yoest@dowjones.com

Click here to go to Dow Jones NewsPlus, a web front page of today's most important business and market news, analysis and commentary: http://www.djnewsplus.com/access/al?rnd=rZCMrES36KADT2R4MArh5g%3D%3D. You can use this link on the day this article is published and the following day.

(END) Dow Jones Newswires

May 11, 2009 11:27 ET (15:27 GMT)

Copyright (c) 2009 Dow Jones & Company, Inc.- - 11 27 AM EDT 05-11-09

Saturday, May 9, 2009

The Gargantuan Gov't Obama is Creating Explained; Short-Run vs Long-Run Ramifications are Key to Understanding Consequences on Capitalism...

Weekend Greetings to all,

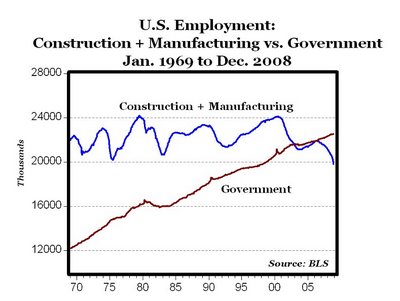

Some talking heads are celebrating the Unemployment Rate of 8.9% since the number showed a contraction in the latest week. Yet if you look under the hood, you'll see gov't jobs piling up fast, as we predicted after Obama won. Census workers are being added to the tune of 66,666 per month, and are supposed to continue to smooth the rate through year end: http://www.mcclatchydc.com/251/story/67789.html CNBC mentioned many unemployed professionals are taking these gov't service jobs. Although helpful in the short-run, Capitalist Pig Bob thinks the American economy is being dumbed down at the expense of the real estate and credit crisis. A paradox unfolding for investors, traders, and lovers of free-market capitalism. This is not and will not be an easy market to trade, since the $3.4T budget will have 'positive' short-run social and fiscal effects, arguably. Because the stock market is a discounting mechanism, we expect volatility through year end (S&P 750 - 1,050), as donks work to pass their control agenda of nationalized health care, Cap and Trade, EFCA, and who knows what kind of economic mutations will result from TARP? Thus, the political component will continue to whipsaw the PFF ratio for the S&P from month to month due to pro and anti-capitalistic rhetoric and legislation. Capitalist Pig Bob does not think 60 donkey Senators, the likes of Nancy "Judas" Pelosi, will ever embrace American principles of smaller gov't and lower taxes. Just the opposite, CPB thinks we are in for a smoothing type effect in unemployment never witnessed before, as mediocre gov't jobs are created through budget deficit spending. This gargantuan Capital Hole will choke-off many healthy private sectors in the long-run. Isn't it ironic the gov't suddenly thinks the best way to prosperity is to spend borrowed money? That is exactly how the ongoing real estate/credit crisis began in the private sector. Do two wrongs make a right dear Sir and Madame Senator? The consequences of even creating such a deficit has never proved successful in modern history. Yet the paradox of this spend in the short-run will fool the masses in believing this administration. Fiscal conservatism demands lowering taxes on businesses and the American worker, not forcing them to adjust to a Big Brother playground. By the way, what's the latest news regarding the toxic bank assets? Perhaps CNBC is being strategically used by the scholarly Obama economic team to feed us anything they need to to rejigger America in their big gov't image. CPB would rather suffer and see the stock market fall than to witness a robotic society created as a result of a short-term hiccup. Understand the ease Obama will have to pass his leftist agenda if stocks continue to rally. Some Americans today believe Obama is responsible for this extreme short covering rally that is beginning to create real wealth. CPB cautions you to monitor your Senators and Congressmen/women over the next several weeks to months. Washington Post's highly respected political journalist, Charles Krauthammer, recently pointed out: Obama has a limited window of time to change this country by legislating his redistribution of wealth agenda. Are you cheering or telling your friends and family about what's happening?

Friday, May 8, 2009

Nancy "Judas" Pelosi Must Resign or be Fired for Lying and Siding with some Spanish Loon Against President Bush, the Man from Texas

Double donkey standard will not get lost with Capitalist Pig Bob. CPB insists Nancy Pelosi resign or be removed as House Speaker: http://www.independent.org/blog/?p=2111

Double donkey standard will not get lost with Capitalist Pig Bob. CPB insists Nancy Pelosi resign or be removed as House Speaker: http://www.independent.org/blog/?p=2111

Could only imagine IF this was a republican woman, the wrath of the godless donkeys would come down with full force of tongue and mass media.

Thursday, May 7, 2009

The Problem with Allowing TARP Payback for a Few Banks will Create a New Conundrum in the Banking Sector; Definitely Something to Monitor...

*DJ JPMorgan CEO: Still Waiting To Hear Steps For TARP Repayment

.

(MORE TO FOLLOW) Dow Jones Newswires

May 07, 2009 18:50 ET (22:50 GMT)

Copyright (c) 2009 Dow Jones & Company, Inc.- - 06 50 PM EDT 05-07-09

*DJ JPMorgan CEO: Still Waiting To Hear Steps For TARP Repayment

.

(MORE TO FOLLOW) Dow Jones Newswires

May 07, 2009 18:50 ET (22:50 GMT)

Copyright (c) 2009 Dow Jones & Company, Inc.- - 06 50 PM EDT 05-07-09

Wednesday, May 6, 2009

Budget Shifts to Raising Sin Taxes on Cigs, Al K. Hall, and now Internet Gambling and maybe even Marijuana, Fiscal Liberalism in Emergency Room Mode..

WASHINGTON (Dow Jones)--A senior House Democrat introduced bills Wednesday that would suspend rules banning Internet-based gambling and seek to regulate it instead.

A third bill introduced by a Democratic member of the Ways & Means Committee would ensure that online gaming companies would start paying taxes to the U.S.

According to a recent study from consultancy PricewaterhouseCoopers, the U.S. Treasury could stand to gain $48.6 billion annually by taxing online gambling companies.

This is the second consecutive year that the bills have been brought forward, in an attempt to undo a move in the dying days of the Republican-controlled Congress in 2006 to ban Internet gambling.

House Financial Services Chairman Barney Frank, D-Mass., said Wednesday at a press conference introducing his bills that he hadn't spoken to either House or Senate leadership, nor to the Obama administration about the bills.

But he said he planned to push the legislation through his committee before Congress breaks in August.

Rep. Jim McDermott, D-Wash., is the author of the bill that would tax regulated online gaming companies.

The ban is set to go into place in December 2009, after the Bush administration moved to put rules enacting the ban in place in its final weeks at the end of 2008.

Frank's legislation would allow companies to apply for a license allowing it to provide its gambling services to U.S. residents. Applicants would have to meet the same standards as individuals wanting to work in the Las Vegas gambling industry. They would have to be willing to subject to a review of their financial condition, corporate structure and business experience.

Companies would have to put in place controls to ensure that neither minors nor residents in states with laws in place banning online gambling could access their sites.

It would also attempt to mollify the concerns of professional sports leagues by continuing a prohibition on gambling on professional sports.

Under the rules that are currently set to go in place, it would be up to financial services companies that process credit and debit card transactions to determine which are related to illegal gambling activities.

As such, the industry strongly objected to the rules, arguing that they shouldn't be expected to be sheriffs determining what transactions are against the law.

Frank said that Rep. Shelley Berkley, D-Nev., who represents Las Vegas, is one of the co-sponsors of the bill. Berkley was a vocal supporter of a ban on online gambling in the past.

The American Gaming Association, which counts among its members many of the large casino operators, has decided to remain neutral over the issue. The group had been another strong opponent of online gambling in the past.

-By Corey Boles, Dow Jones Newswires; 202-862-6601; corey.boles@dowjones.com

Click here to go to Dow Jones NewsPlus, a web front page of today's most important business and market news, analysis and commentary: http://www.djnewsplus.com/access/al?rnd=2mGhBVCXrMyghSy2py0uGA%3D%3D. You can use this link on the day this article is published and the following day.

(END) Dow Jones Newswires

May 06, 2009 14:00 ET (18:00 GMT)

Copyright (c) 2009 Dow Jones & Company, Inc.- - 02 00 PM EDT 05-06-09

Biotech Monster Emerges After Close; Forward-Thinkers Should Monitor Fanapt's SAFETY, as VNDA's Momentum Could Pivot 180 within 4 Months, Caution...

Shares of Vanda Pharmaceuticals Inc. (VNDA) shot up in late trading to $9.79 from their Wednesday closing price of $1.08, after the company said the Food and Drug Administration approved its schizophrenia drug.

Fanapt received marketing approval for the acute treatment of adult patients with schizophrenia after two Phase III clinical trials comparing the drug with placebos and early data from more than 3,000 patients.

"The approval of Fanapt marks a new opportunity for many patients with schizophrenia who experience only partial responses to current therapies," said Dr. Peter Werden, a psychiatry professor at the University of Illinois in Chicago.

Vanda plans to have the drug available in pharmacies later this year.

-By Kathy Shwiff, Dow Jones Newswires; 201-938-5975; Kathy.Shwiff@dowjones.com

Click here to go to Dow Jones NewsPlus, a web front page of today's most important business and market news, analysis and commentary: http://www.djnewsplus.com/access/al?rnd=2mGhBVCXrMyghSy2py0uGA%3D%3D. You can use this link on the day this article is published and the following day.

(END) Dow Jones Newswires

May 06, 2009 19:03 ET (23:03 GMT)

Copyright (c) 2009 Dow Jones & Company, Inc.- - 07 03 PM EDT 05-06-09

Shares of Vanda Pharmaceuticals Inc. (VNDA) shot up in late trading to $9.79 from their Wednesday closing price of $1.08, after the company said the Food and Drug Administration approved its schizophrenia drug.

Fanapt received marketing approval for the acute treatment of adult patients with schizophrenia after two Phase III clinical trials comparing the drug with placebos and early data from more than 3,000 patients.

"The approval of Fanapt marks a new opportunity for many patients with schizophrenia who experience only partial responses to current therapies," said Dr. Peter Werden, a psychiatry professor at the University of Illinois in Chicago.

Vanda plans to have the drug available in pharmacies later this year.

-By Kathy Shwiff, Dow Jones Newswires; 201-938-5975; Kathy.Shwiff@dowjones.com

Click here to go to Dow Jones NewsPlus, a web front page of today's most important business and market news, analysis and commentary: http://www.djnewsplus.com/access/al?rnd=2mGhBVCXrMyghSy2py0uGA%3D%3D. You can use this link on the day this article is published and the following day.

(END) Dow Jones Newswires

May 06, 2009 19:03 ET (23:03 GMT)

Copyright (c) 2009 Dow Jones & Company, Inc.- - 07 03 PM EDT 05-06-09

Tuesday, May 5, 2009

Gov't Vouchers for Cars? Capitalist Pig Bob thinks Obama is Crossing the Public-Private Sector Line; Subsidizing Private Business Decisions MUST STOP!

WASHINGTON (Dow Jones)--U.S. House lawmakers reached an agreement Tuesday on a program to provide government-funded discounts for trading-in old cars for more-efficient models, but Republican support remained uncertain.

Under the new proposal, consumers would receive vouchers worth up to $4,500 toward new, more fuel-efficient cars and trucks. The program would last a year, and would provide vouchers for about 1 million purchases, according to a fact sheet released by House Energy and Commerce Committee Chairman Henry Waxman, D-Calif. The program would be authorized as part of the American Clean Energy and Security Act of 2009, according to Waxman's office.

Rep. Betty Sutton, D-Ohio, and Rep. Steve Israel, D-N.Y., led the drive for the program in the House.

Lawmakers still must find funding for the program. Some have suggested the money would come from the economic stimulus package passed earlier this year.

President Barack Obama has signaled support for the concept of a so-called "cash for clunkers" program, as have House Speaker Nancy Pelosi, D-Calif., other Democrats and several Michigan Republicans. But Republican congressional leaders were apparently not heavily involved in talks on the proposal.

-By Josh Mitchell, Dow Jones Newswires; 202-862-6637; joshua.mitchell@dowjones.com

Click here to go to Dow Jones NewsPlus, a web front page of today's most important business and market news, analysis and commentary: http://www.djnewsplus.com/access/al?rnd=W6UuMrXOzzpS27SyD3zXzg%3D%3D. You can use this link on the day this article is published and the following day.

(END) Dow Jones Newswires

May 05, 2009 14:38 ET (18:38 GMT)

Copyright (c) 2009 Dow Jones & Company, Inc.- - 02 38 PM EDT 05-05-09

Forward-Thinkers Take Note: Identify Trades Poised to Benefit from the Infancy of the BioFuel Rush; Perhaps Farm Related Suppliers Win Big...

PRESIDENT OBAMA ISSUES PRESIDENTIAL DIRECTIVE TO USDA TO EXPAND ACCESS TO BIOFUELS

USDA, EPA and DOE form Biofuels Interagency Working Group to increase energy independence

WASHINGTON, D.C. (May 5, 2009) - President Obama issued a presidential directive today to Secretary Vilsack to aggressively accelerate the investment in and production of biofuels. On a conference call with Energy Secretary Stephen Chu and Environmental Protection Agency Administrator Lisa Jackson, Vilsack also announced that he will help lead an unprecedented interagency effort to increase America's energy independence and spur rural economic development.

"President Obama's announcement today demonstrates his deep commitment to establishing a permanent biofuels industry in America," said Vilsack. "Expanding our biofuels infrastructure provides a unique opportunity to spur rural economic development while reducing our dependence on foreign oil - one of the great challenges of the 21st century."

Increasing renewable fuels will reduce dependence on foreign oil by more than 297 million barrels a year and reduce greenhouse gas emissions by an average of 160 million tons a year when fully phased in by 2022. On the call, Jackson announced that the EPA would establish four categories of renewable fuels, some of which would be produced form new sources. To address lifecyle analysis, the EPA said they are soliciting peer reviewed, scientific feedback to ensure that the best science available is utilized prior to implementation.

"Producing clean, renewable energy in our country is a powerful rural development tool that creates jobs domestically while generating new tax revenues for local, state, and federal governments," added Vilsack.

President Obama directed Secretary Vilsack to expedite and increase production of and investment in biofuel development efforts by:

Refinancing existing investments in renewable fuels to preserve jobs in ethanol and biodiesel plants, renewable electricity generation plants, and other supporting industries; and

Making renewable energy financing opportunities from the Food, Conservation and Energy Act of 2008 available within 30 days. These opportunities include:

Loan guarantees for the development, construction, and retrofitting of commercial scale biorefineries and grants to help pay for the development and construction costs of demonstration-scale biorefineries;

Expedited funding to encourage biorefineries to replace the use of fossil fuels in plant operations by installing new biomass energy systems or producing new energy from renewable biomass;

Expedited funding to biofuels producers to encourage production of next-generation biofuels from biomass and other non-corn feedstocks;

Expansion of Renewable Energy Systems and Energy Efficiency Improvements Program, which has been renamed the Rural Energy for America Program, to include hydroelectric source technologies, energy audits, and higher loan guarantee limits; and

Guidance and support for collection, harvest, storage, and transportation assistance for eligible materials for use in biomass conversion facilities.

The Biofuels Interagency Working Group will develop the nation's first comprehensive biofuels market development program. The increased collaboration between federal agencies will accelerate the production of and access to sustainable homegrown energy options by coordinating policies that impact the supply, secure transport, and distribution of biofuels, as well as identifying new policy options to improve the environmental sustainability of biofuels feedstock production.